These four top startup credit cards have very different approaches to rewards programs.īrex's approach is similar to that of most credit cards, offering specific amounts of Brex rewards points for various types of purchases. Most of the best corporate credit cards advertise based on their rewards because you can watch them pay off in real dollars. These travel cards are an attractive money-saving option for companies where business travel is a core component of their operations. Because of their robust networks, some of these cards are able to offer compelling travel rewards programs, in particular, complete with TSA Precheck, Global Entry and CLEAR membership discounts. Rewards: Traditional corporate cards offer bonus points, cash rewards or gift cards on purchases made some of which are more rewards-based than others which are more cash-back based.They also may offer balance transfers, access to additional financial resources, exclusive sign-up offers, introductory APRs and more. Perks: Card members can access a line of credit (a key benefit to this type of card) and, if necessary, pay off their balance with monthly payments over a period of time with interest.You will also be subject to interest rate fees for any balance carried over. Card fees: While application fees are not common, annual card fees may apply depending on the card issuer and type.Your acceptance and credit limit may be impacted by your personal credit score, in addition to your company's credit history. Application & Qualification: Applying for a traditional small business credit card often requires founders or business owners to undergo a personal credit check and may require a personal guarantee if your business does not meet the credit card issuer's minimum annual revenue threshold.Some highly-regarded and recognizable names include American Express, Capital One, Chase and, amongst the venture-backed startup community, Silicon Valley Bank. Providers: Most major credit bureaus and financial institutions offer corporate programs for small businesses and large enterprises. What is the difference between a corporate card and a traditional business credit card?īefore we review the various features of this new breed of corporate credit cards, let's first review a few points for how they differ from traditional business credit cards. See also: Hit the Books: When To Hire a Bookkeeper For Your Startup Read on for our comprehensive business credit card comparison.

The only way to choose the best one is to compare their features. While all four of these cards work this way, they have plenty of differences.

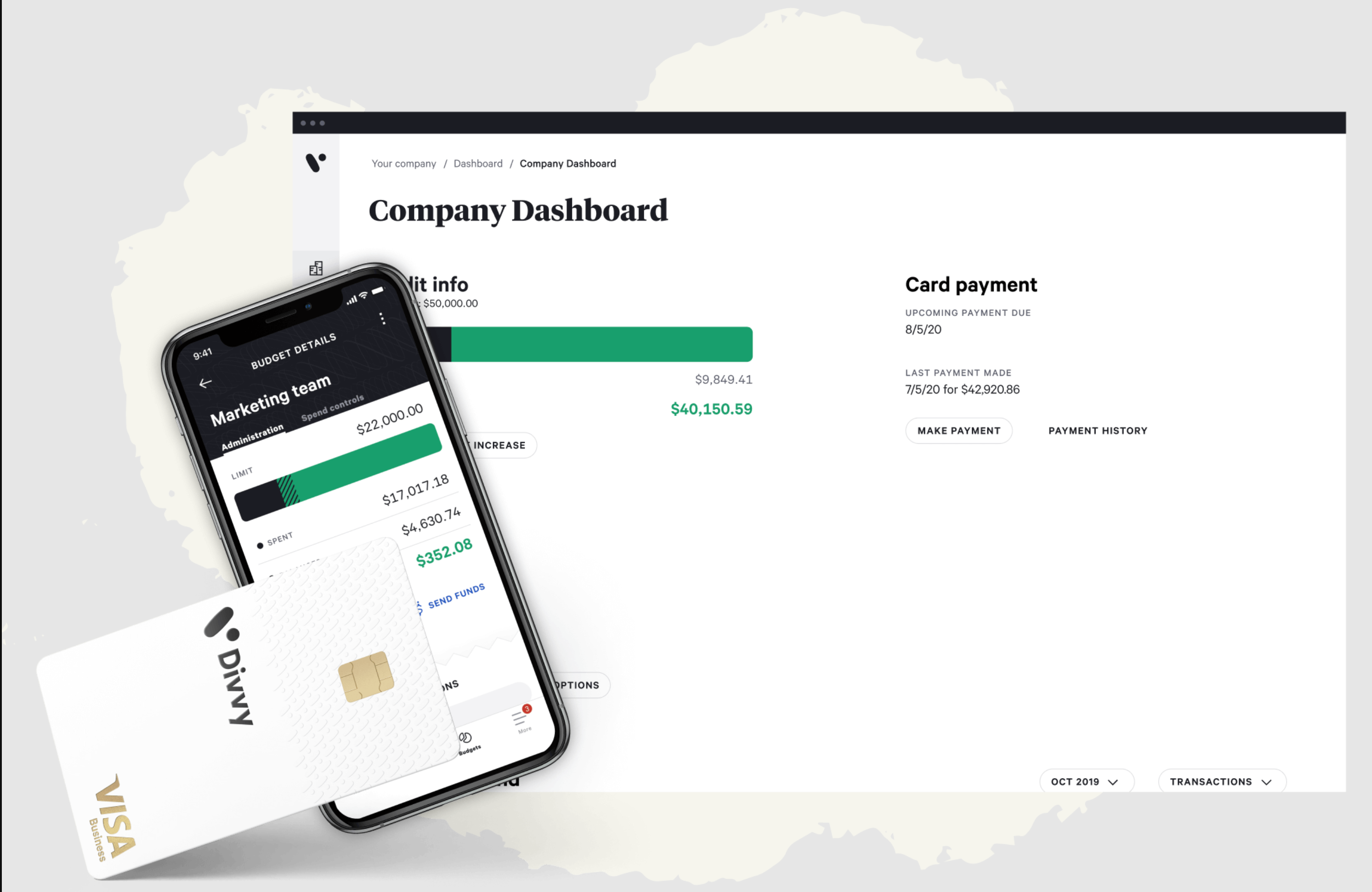

These cards are also unique in that they do not require a personal guarantee, personal credit check or credit score of the business owner to open an account, relying instead on a company's cash flow to determine credit limits - more on this later. The card providers make money by charging fees to your merchants instead of charging you interest. You'll pay it off every month, which keeps your business out of debt. This means you can't carry a balance on these cards. These four cards are unique because they're more like charge cards than traditional credit cards. Take a look at four unique options: Brex, Divvy, Ramp, and Stripe. You already know how typical personal credit cards work, but when it comes to your business, it's time to think outside the box. The Top 4: The Best Corporate Credit Cards for Startups See also: Startup Bookkeeping: Common Mistakes VC-Backed Startups Make and How We're Solving Them

To give yourself and your business the best chance for success, compare these four choices among the best business credit cards for startups. Between fees, rewards, and other features, taking your time to research your options could pay off to the tune of thousands of dollars.Īs you do your homework, remember that not all corporate credit cards are meant for startups or small businesses. And as it turns out, the card you use to spend that money can have a major impact on your business.Ĭomparing the best corporate credit cards for your startup can feel overwhelming, but resist the urge to snag the first one you find. Searching for the best business credit cards for startups? You've come to the right place.Īs they say, you have to spend money to make money.

0 kommentar(er)

0 kommentar(er)